Paysafecard would be nice as well.

As someone in the US, I can confirm that the view expressed by the OP is US-centric.

To the OP’s point, if you do not have a credit card, privacy.com can provide a “virtual credit card” that is linked to a bank account of one’s choosing. You can set limits, one time use, etc on the individual cards. It’s great for online payments.

Link to website above.

Link to my shameless referral link plug is here: Referral

Unfortunately:

Privacy is currently available to US citizens or legal residents with a checking account at a US bank or credit union, and who are 18+ years of age. Unfortunately, we don’t support international bank accounts or non-US users at this time.

Otherwise a great idea.

Fair point. I did not realize it was that US-centric.

BTW: I’m in agreement with other payment options, such as PayPal.

No problem. Would love to use such a service.

I’m dying ![]()

Accuses me of being US-centric:

Proceeds to suggest US-only service:

I don’t know why everyone is so enraged by the “credit” part of the card.

That is not even relevant. The relevant point is using one of the largest and established payment networks, visa, mc, etc.

Users financial arrangement with the bank does not affect payments to storj in any way.

I said “credit card” because that’s pretty much a synonym of plastic card where I live, and while some stubborn or misinformed users still use debit cards — there are no reasons to do so and plenty of reasons not to. But nothing in my arguments change if you remove the word credit and replace it with network designation.

That’s another thing. Most debit cards in US, in addition to supporting weird and anachronistic interbank payment networks also have VISA or MC logo and can be just on these networks.

In fact, my debit card only support visa. That’s the only network it operates on. Arguably, tracking fraud on a massive scale is more effective than trying to protect little ancient interbank payment network.

Credit providers make most of the money on merchant fees, not late fees. So much so, that they kick back some of it back to the user in the form of various perks and benefits. Many cards don’t have late fees to begin with. Or any fees for that matter. Then there are charge cards, where you can’t carry balance (not that you ever should with credit cards)

On the other hand if you overdraft your debit card I’m sure some banks will charge you too. I don’t see the difference from that perspective.

The problem of late fees is completely eliminated by setting up auto payment.

On the other end, if you pay with debit card, you still are indirectly paying similar processing fees and same prices but don’t benefit from it in any way.

How is this different from a debit card? It’s not different on the “leaking info” front, but dramatically different on a liability side. Credit cards provide significantly better fraud liability protection. If your card info is stolen your financial responsibility is big fat zero.

Some debit card issuers have similar protections, but with drastically different liability levels, reporting requirements, and what’s more important — you are out of your money while banks investigate. This is not the case with credit and charge cards, because you are not paying with your own money to begin with, and you are not required to pay for transactions under dispute.

So the exact opposite is true: for everything, especially online purchases, it’s reckless and irresponsible to not to use credit card and risk exposing access to your own money.

Correct. Through higher prices due to higher merchant fees passed down to you. Except you are paying that anyway, but if you yourself don’t use credit — you are not getting any benefits, only drawbacks.

The remaining use case for debit card is just one- extract and deposit cash from/to atm. For anything else these are I’ll-fitting.

Understood. So this is yet another, Nederland-specific inter-bank payment system, getting adopted across EU. Visa and Mastercard serve the same purpose among other things but but globally — but I can see how being US companies EU countries may wanted their own. And yet, PayPal is also an US company, and not the the most respectable either…

This is literally putting the burden to the uer. Why? To limit own liability. “I don’t know anything, you approved the transaction with your bank, next!”

This disentivises banks and network services from implementing better fraud detection systems.

US credit card system is perfect: here is card number (even though payments today are authenticated online and traffic is encrypted) use it to pay. And if fraud occurs — sorry dear user we missed that, we apologize, you don’t have to do anything. Companies are financially incentives to combat fraud. Because if data is leaked money comes from their pocket. Not the users’.

I wasn’t.

Again, not in many countries. Large parts of Europe use Maestro and V-Pay as their main card types. Though both of those are planned to be phased out now. As it stands many payment terminals don’t even accept Mastercard or Visa and even if the terminals do, many retailers choose to not allow credit card payments because of the fees. The world is bigger than just the US.

The debit cards we we get with our bank accounts simply do not have the 16 digit numbers. So no, Mastercard or Visa payment options online are not helpful. The only way we can use those is with a credit card, which comes with annual fees, merchant fees and yes, late fees and insanely high interest. Only the interest part can be resolved with a charge card. Also, flat overdraft fees on checking accounts are also a US only thing as far as I’m aware. We just pay interest on negative balance. Though that interest can be really high if you don’t have a credit feature on your account is it’s kind of a fine in that case. But we would never pay like $30 for a $1 overdraft like in the US. (It’s been a while since I heard about those, the dollar amount can be wrong.)

For context only 38% of people in the Netherlands age 15+ even have a credit card and their debit cards can’t be used to pay online. We use iDeal for that or things like PayPal.

Oh boy… Yeah, I think the above tells you why using the term credit card for any plastic card makes no sense in NL. Also, I listed all the waist in fees, which to me is a pretty good reason to avoid credit cards. More context then. Retailers pay a flat monthly fee to be able to do transactions with debit cards here. That fee covers rental of the payment terminals and free transactions. No merchant fees per transaction. And honestly, I have no clue why you think credit card companies deserve to get 1-3% of every transaction. You do realize you end up paying for that, right?

I’ll grant you that first part. Regulations have for the most part put a stop to predatory late fee practices. But I didn’t ask for the perks. I’d rather them not take my money in the first place (and yes, it would be my money, since merchants just raise the prices to cover the fees).

As mentioned, just interest. If you resolve it quickly, there is no issue. And if you always have a positive balance, this doesn’t even come up. While with a credit card you could run into this even if you do have money on your account.

Nope, I live in a country where credit cards aren’t the norm. And no merchant fees on transactions are the norm. So our prices aren’t inflated by those fees. Merchants just often choose to not even accept credit card payments because of those fees.

Great. So who ends up paying for that? Oh right, you. Because that liability needs to be covered by all the other fees. As mentioned, our debit cards don’t have all the info on them to pay for things online. You steal a card here and you would by definition need to know the pin number to make any payments with them, which means much less fraud to begin with and less waste in the system. So there absolutely is a massive difference. Less fraud means lower cost for banks and it’s why they can have no merchant fees and no annual fees.

For online purchases, we use methods that can’t even lead to leaks that allow for payment data to be used to make additional payments. Again, much less fraud and costs in the system, leading to much less costs to using the system. If I pay using iDeal, the webshop never holds my payment information. They just get a confirmation from my bank that I’ve paid. PayPal is similarly safer then leaving your credit card info, especially if PayPal itself doesn’t have your credit card info either.

Except I’m not paying for any of that, because wasteful credit cards aren’t the norm here. And they shouldn’t be anywhere. The US is just broken when it comes to payment systems and you have to deal with that, while the credit card companies make bank on that broken system. I don’t.

I think you must start to see now how US-centric this conclusion is.

It’s not that they want their own thing, it’s that they want something better and more secure. Anyone can use Mastercard and Visa here, but merchants don’t want it and consumers don’t want it for all the reasons I just mentioned. What fhey want is a universal standard that is secure and prevents fraud without filling the pockets of inbetween payment providers. iDeal and in the future Wero will do just that. I’d love for it to be more than just European, but you gotta start somewhere. Mastercard and Visa just aren’t cutting it.

It’s not my first choice either, but until Wero covers all of Europe, it’s quite unreasonable to expect Storj to adopt something like iDeal and all other country specific variations. PayPal has become a useful universal inbetween. But I’d rather have something like Wero become the global standard so you don’t need an inbetween.

How backwards is this conclusion? It doesn’t put the burden on the user, it prevents payment fraud from happening in the first place. The bank verifies the contract with the retailer and shows the name of the retailer while you confirm the transaction, so you know who you’re paying. And it ensures that I’m the only person who can even do that transaction, because it enforces the secure multifactor authentication my bank uses. Unless you; have my phone, are somehow able to unlock it and know my pincode, you can’t make that transaction. Fraud prevention is better than fraud detection.

![]()

Not even close, my friend.

And yet, with all the methods I just mentioned being developed around the world, credit card fraud is still rampant. They haven’t solved it, they just raise the fees instead. Completely preventable fraud is happening every day with credit cards because the entire system is badly secured. So bad that companies like privacy.com can make even more money on top of credit card companies by inventing a hacky extra layer to put the burden on the user as you said it so well. Any system that requires you to hand over all the information required for payment to a third party other than your own bank is severely and utterly broken and will inevitably lead to fraud that you end up paying for. No thanks.

Ps. If fraud does happen here, banks still cover the costs, but because almost all methods that lead to the vast majority of credit card fraud have been eliminated, this doesn’t lead to added costs for the consumer or merchant and it’s a drop in the bucket for banks. Skimming at ATMs used to be a big problem, which is why banks quickly moved away from using magnetic strips in favor of the EMV chip. But that method required modifying an ATM by placing a magnetic card reader on it and installing a camera to read the pin entered. That’s the level of sofistication that was required to do payment card fraud and even that has since been eliminated. Literal phishing of cards and letters with pin codes out of physical letter boxes is pretty much the last prevalent form of card fraud that remains here with debit cards.

Guilty as charged. ![]()

Using PayPal as a payment method is very expensive to operate compared to card payments because PayPal charges a very high Merchant Discount Rate (MDR). For example, currency conversions are 3% above the base exchange rate (aka for non-USD payments), plus there are chargeback fees, refund fees, a fixed fee, card MDR on PayPal, bank transfer MDR on PayPal, PayPal credit fees, and so many other fees that businesses have to bear to operate with the PayPal payment method.

Kiwi, Yoomoney, Yandex.Money, WebMoney, PerfectMoney, (hundreds other), …

OMG ![]()

Do you really believe it’s possible to implement support of all of these electronic payment systems?

For me the simplest way to pay for the service is STORJ tokens - no need any bank or electronic money system (which took fees in one way or another anyway), much more convenient. However, the problem of currently high fees on Ethereum is limiting factor of course, so I think that implementing a zkSync Era payments will solve this issue too

I have had only a negative experience with PayPal unfortunately due to my nationality. So I would not suggest to use it to anyone.

Seems debit cards works too:

And I believe that almost any bank can issue such a card and often - for free.

But you need to have a balance on it to do not finish with a frozen Storj account due to debts. So in this case the credit card would be more useful (but costly, if you forgot to top-up it before the grace period would end).

I believe Storj is using Stripe as payment processor?

They offer many different payment methods to choose from: https://stripe.com/en-de/payments/payment-methods

I don’t know what it takes to actually offer those to customers. But it seems that everything could be done via a single provider.

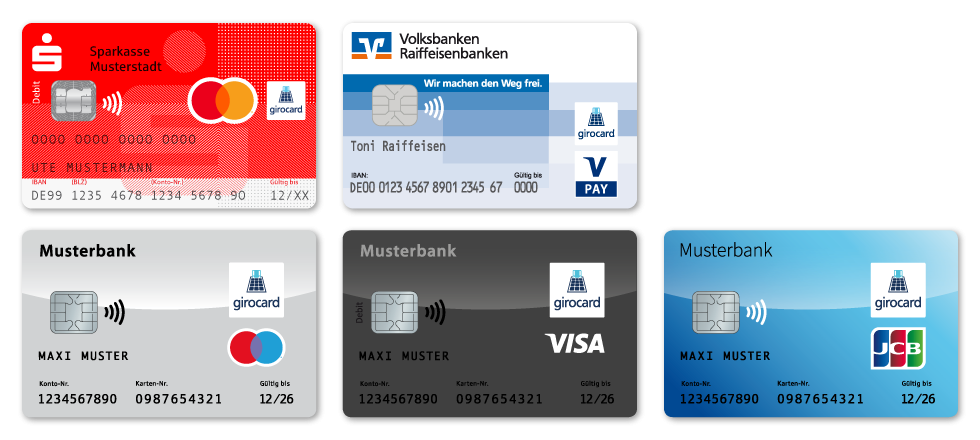

What @zip is referring to seems to be a MC = Mastercard (?) debit card. This is not the kind of debit card @BrightSilence was talking about.

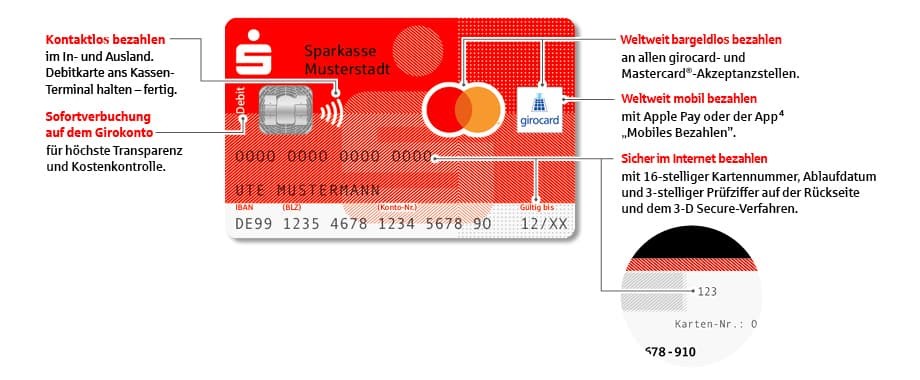

Here is an example picture of what such a bank issued debit card can look like in Germany. I don’t see how these could be used where a credit card is required. They don’t even have the required number.

The question again is not whether or not someone can get a credit card. The question basically is, does Storj want to offer payment methods that people (depending on country) actually use or do they want to force users to use only specific payment methods and lose potential customers who don’t use credit cards or crypto for whatever reason.

Do you really believe it’s possible to implement support of all of these electronic payment systems?

I definitely don’t. As I mentioned in my earlier comment. But when there is a single European standards later when Wero goes live, it might be worth it. Time will tell.

And I believe that almost any bank can issue such a card and often - for free.

MC Debit and Maestro aren’t the same thing. The cards banks issue here never have the 16 digit number to pay online. Only credit cards do.

Using PayPal as a payment method is very expensive

But getting a credit card for the sole purpose of paying Storj might not be necessarily free for the customer either.

I have just checked one of the largest German banks here: Kreditkarte | Einfach online beantragen | Deutsche Bank (unfortunately it is in German).

But you can see under “Jahresbeitrag” the price for one year which is between 39 and 94 EUR.

Now put that on top on your monthly Storj bill and suddenly it is no longer so cheap for a user with small backup needs. Of course if you plan to store many terabytes of data it is not that relevant.

But 3,25 EUR per month is almost worth 1TB of data stored on Storj DCS.

Debit card still works in Storj. There is one online bank which got full banking license in 2016 and provides a free virtual debit card in Germany, N26 Standard, for €0.00/month.

or get Physical card for €10.00

Here is an example picture of what such a bank issued debit card can look like in Germany. I don’t see how these could be used where a credit card is required.

This debit Mastercard you should be able to use, at least here with Storj:

I’m also not sure the card actually needs to have a 16 digit serial number. I know people with debit VISA having more than 16 digits, and they are using it on the Internet via various payment processors for online shopping without any issues. Some of the processors even recognize automatically what kind of a card that is based solely on the serial number. But I do not remember if Storj requires exactly 16 digits or if it can be even more.

I also had Maestro in the past and that was an issue sometimes as it was not accepted everywhere, but then the bank stopped using them and issued MC.

if it has CVC, it likely can be used. I do not know, which card payment systems are allowed, I only used Visa and MasterCard.

This debit Mastercard you should be able to use, at least here with Storj

Yes, this seems to be a very interesting combination of a bank issued debit card and a Mastercard debit card. Therefore it has all the characteristics known from the regular MC credit cards:

For this specific card you need an account with the bank “Sparkasse” and it costs between 9 Euro and 12 Euro per year from what I saw. So it is also not free.

For this specific card you need an account with the bank “Sparkasse” and it costs between 9 Euro and 12 Euro per year from what I saw. So it is also not free.

Yes, but still significantly cheaper than with local banks here for approximately 7€ a month. Do you still take Fleuchtlinge in Germany? ![]()

If it was up to me, I would try to accept:

- Credit Card

- Paypal

- Amazon Pay

- Alipay

- ApplePay

- Other cryptos (e.g. BTC, DOGE) while maintaining a discount exclusively for payment with STORJ

- Payment via regional providers for specific markets like for e.g. Germany Klarna/Sofortüberweisung, Giropay, Ratepay

- Paysafecard

- Invoice and direct debit for dedicated and verified customers (like large companies and public/governmental agencies)