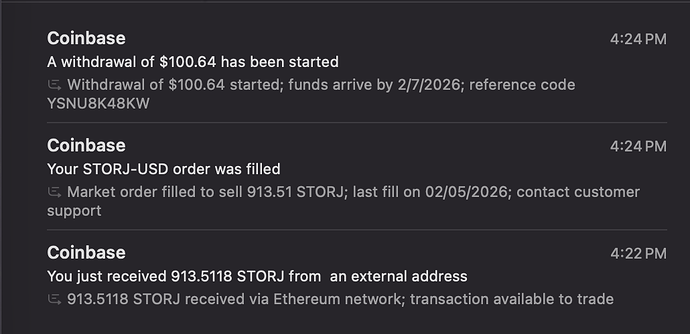

But you see, it’s now [checks time] 2026, so you don’t have to learn something to do something. We have robots.

This is what the robot produced during my 20 min commute to work this morning, over the voice (!) chat. I haven’t tested this, but I’m sure with minor massaging it can be made to work.

:warning: BELOW IS AN UNADULTERATED AND UNAUDITED AI VOIMT :WARNING: USE IT AT YOUR OWN RISK :SKULL: NO HUMAN MEANINGFULLY REVIEWED THIS

Below is the complete deployment guide for an automated Storj → USD market sell on Coinbase, including the single-file Python script, webhook setup, and optional Caddy HTTPS termination.

Storj Auto-Sell to USD — Complete Guide

Overview

You will:

-

Run a Python webhook listener that:

- Receives Coinbase on-chain deposit notifications

- Verifies webhook signatures

- Immediately places a market sell order via Coinbase Advanced Trade API

-

Expose it to the internet via valid HTTPS

- Either with Cloudflare Tunnel (already solved for you)

- Or with Caddy + Let’s Encrypt (covered here)

Requirements

- Public HTTPS endpoint for webhook (Cloudflare or Caddy)

- Coinbase account with API keys (with trade permission)

- Python 3.9+ installed

Environment Variables

COINBASE_API_KEY

COINBASE_API_SECRET

WEBHOOK_LISTENER_SECRET # from subscription creation

STORJ_CONTRACT_ADDRESS # STORJ ERC-20 contract

WATCHED_WALLET_ADDRESS # your deposit address

WEBHOOK_HOST # https://your.domain

Set these before running the Python script.

Single Python Script — storj_autosell.py

#!/usr/local/bin/python3

import os, sys, time, json, uuid, hmac, hashlib, base64, logging

from typing import Optional

import requests

from flask import Flask, request, abort

# ───────────────────────── Logging ─────────────────────────

logging.basicConfig(

level=logging.INFO,

format="%(asctime)s %(levelname)s %(message)s",

)

log = logging.getLogger("storj-autosell")

# ───────────────────────── Environment ─────────────────────

required_env = [

"COINBASE_API_KEY",

"COINBASE_API_SECRET",

"WEBHOOK_LISTENER_SECRET",

"STORJ_CONTRACT_ADDRESS",

"WATCHED_WALLET_ADDRESS",

"WEBHOOK_HOST",

]

missing = [e for e in required_env if not os.environ.get(e)]

if missing:

log.critical("missing env vars: %s", missing)

sys.exit(1)

API_KEY = os.environ["COINBASE_API_KEY"]

API_SECRET = os.environ["COINBASE_API_SECRET"]

WEBHOOK_SECRET = os.environ["WEBHOOK_LISTENER_SECRET"]

STORJ_CONTRACT = os.environ["STORJ_CONTRACT_ADDRESS"]

WATCHED_ADDR = os.environ["WATCHED_WALLET_ADDRESS"]

HOST_URL = os.environ["WEBHOOK_HOST"]

CDP_BASE = "https://api.cdp.coinbase.com"

ADV_BASE = "https://api.coinbase.com"

HTTP_TIMEOUT = 10

MAX_RETRIES = 5

processed_tx = set() # prevents duplicate sells (in-memory)

# ───────────────────────── Coinbase Signing ────────────────

def sign_request(method: str, path: str, body: str = ""):

ts = str(int(time.time()))

prehash = ts + method + path + body

sig = base64.b64encode(

hmac.new(API_SECRET.encode(), prehash.encode(), hashlib.sha256).digest()

).decode()

return {

"CB-ACCESS-KEY": API_KEY,

"CB-ACCESS-SIGN": sig,

"CB-ACCESS-TIMESTAMP": ts,

"Content-Type": "application/json"

}

# ───────────────────────── Retry Wrapper ───────────────────

def post_with_retry(url, headers, body) -> Optional[requests.Response]:

for attempt in range(MAX_RETRIES):

try:

r = requests.post(

url,

headers=headers,

data=body,

timeout=HTTP_TIMEOUT,

)

if r.status_code < 500:

return r

log.warning("server error %s — retrying", r.status_code)

except requests.RequestException as e:

log.warning("request failure: %s", e)

time.sleep(2 ** attempt)

log.error("max retries exceeded for %s", url)

return None

# ───────────────────────── Webhook Subscription ────────────

def create_subscription():

path = "/platform/v2/data/webhooks/subscriptions"

body = json.dumps({

"description": "Storj deposit watcher",

"eventTypes": ["onchain.activity.detected"],

"target": {"url": f"{HOST_URL}/webhook", "method": "POST"},

"labels": {

"contract_address": STORJ_CONTRACT,

"event_name": "Transfer"

},

"isEnabled": True

})

headers = sign_request("POST", path, body)

r = post_with_retry(CDP_BASE + path, headers, body)

if not r:

log.error("failed to create webhook subscription")

return

log.info("subscription response %s %s", r.status_code, r.text)

# ───────────────────────── Market Sell ─────────────────────

def place_market_sell():

path = "/api/v3/brokerage/orders"

body_dict = {

"client_order_id": f"sell-storj-{uuid.uuid4()}",

"product_id": "STORJ-USD",

"side": "SELL",

"order_configuration": {"market_market_ioc": {}}

}

body = json.dumps(body_dict)

headers = sign_request("POST", path, body)

r = post_with_retry(ADV_BASE + path, headers, body)

if not r:

log.error("order submission failed (no response)")

return None

try:

payload = r.json()

except Exception:

log.error("non-json order response: %s", r.text)

return None

if r.status_code >= 300:

log.error("order rejected: %s", payload)

return None

log.info("order accepted: %s", payload)

return payload

# ───────────────────────── Webhook Listener ────────────────

app = Flask(__name__)

def verify_sig(sig, payload):

computed = hmac.new(

WEBHOOK_SECRET.encode(),

payload,

hashlib.sha256

).hexdigest()

return hmac.compare_digest(computed, sig)

@app.route("/webhook", methods=["POST"])

def webhook():

payload = request.get_data()

sig = request.headers.get("CB-SIGNATURE-SHA256")

if not sig or not verify_sig(sig, payload):

log.warning("signature verification failed")

abort(400)

try:

evt = request.json

except Exception:

log.warning("invalid json payload")

abort(400)

activity = evt.get("activity") or {}

tx_id = activity.get("transactionHash")

# Idempotency guard

if tx_id and tx_id in processed_tx:

log.info("duplicate event ignored: %s", tx_id)

return {"status": "duplicate"}, 200

if (

activity.get("to") == WATCHED_ADDR and

activity.get("symbol") == "STORJ"

):

log.info("deposit detected: %s", activity)

result = place_market_sell()

if result:

if tx_id:

processed_tx.add(tx_id)

return {"status": "sold"}, 200

log.error("sell failed")

return {"status": "error"}, 500

return {"status": "ignored"}, 200

# ───────────────────────── Startup ─────────────────────────

if __name__ == "__main__":

try:

create_subscription()

except Exception as e:

log.error("subscription creation crashed: %s", e)

log.info("starting webhook listener on :8000")

try:

app.run(host="0.0.0.0", port=8000)

except Exception as e:

log.critical("flask crashed: %s", e)

raise

HTTPS Termination Options

If you already use Cloudflare Tunnel

- Use your Tunnel’s public hostname as

WEBHOOK_HOST

- No local TLS needed

- Ensure Tunnel forwards

/webhook to localhost:8000

Coinbase webhook target → HTTPS Cloudflare → local Flask HTTP.

Optional: Caddy HTTPS Termination

If you do not have Cloudflare Tunnel and need public HTTPS:

- Install Caddy

pkg install caddy

- Caddyfile

Place at /usr/local/etc/caddy/Caddyfile:

storj-autosell.example.com {

reverse_proxy 127.0.0.1:8000

}

- Replace

storj-autosell.example.com with your DNS name.

- Caddy will automatically obtain and renew Let’s Encrypt certificates.

- Start Caddy

service caddy start

- Set:

WEBHOOK_HOST=https://storj-autosell.example.com

before running the Python script.

Steps to Deploy

-

Set up HTTPS (Cloudflare Tunnel or Caddy)

-

Set environment variables

-

Run:

python3 storj_autosell.py

-

Coinbase will deliver webhook events to:

https://<WEBHOOK_HOST>/webhook

-

On deposit, script places a market sell order.

Notes

- You must update

WEBHOOK_LISTENER_SECRET after subscription creation.

- Coinbase API requires trade permissions for order placement.

- Coinbase will deliver only to valid public HTTPS endpoints.